sql-help.ru

Overview

Best Mini Van On The Market

BLUF: The most reliable minivan, based on the empirical data, is the Toyota Sienna, with very reliable (5/5) model years –, – The new Honda Odyssey is ready to take on family adventures in style. This large family van with seating for 8 has parent-friendly features galore. The Odyssey or Sienna are the only two options I would recommend in terms of reliability. If you only plan on keeping it for a couple of years. Here are the top Minivan listings for sale under $ View photos, features and more. What will be your next ride? Honda is known for making mass-market models that are more fun to drive than the average, and that includes the Odyssey minivan, which offers the most driver. Find the best minivans for Discover and compare the best minivans by All minivan/vans. Sports cars. Luxury cars. Apply. Price. Back. Lowest, $2, Currently, the Toyota Sienna tops the list of sql-help.ru's best minivans. After hours of test driving and analysis, our experts assigned the Sienna a rating. The Honda Odyssey is quicker and generally more enjoyable to drive than the Sienna. Not that we expect many minivan buyers to have these qualities as top. Find the Best Minivans & 3-Row SUVs ; Dodge Durango. $39, - $95, ; Ford Explorer. $36, - $56, ; Honda Pilot. $37, - $52, ; BLUF: The most reliable minivan, based on the empirical data, is the Toyota Sienna, with very reliable (5/5) model years –, – The new Honda Odyssey is ready to take on family adventures in style. This large family van with seating for 8 has parent-friendly features galore. The Odyssey or Sienna are the only two options I would recommend in terms of reliability. If you only plan on keeping it for a couple of years. Here are the top Minivan listings for sale under $ View photos, features and more. What will be your next ride? Honda is known for making mass-market models that are more fun to drive than the average, and that includes the Odyssey minivan, which offers the most driver. Find the best minivans for Discover and compare the best minivans by All minivan/vans. Sports cars. Luxury cars. Apply. Price. Back. Lowest, $2, Currently, the Toyota Sienna tops the list of sql-help.ru's best minivans. After hours of test driving and analysis, our experts assigned the Sienna a rating. The Honda Odyssey is quicker and generally more enjoyable to drive than the Sienna. Not that we expect many minivan buyers to have these qualities as top. Find the Best Minivans & 3-Row SUVs ; Dodge Durango. $39, - $95, ; Ford Explorer. $36, - $56, ; Honda Pilot. $37, - $52, ;

The $40, – $50, price range is a sweet spot for minivan buyers. Less expensive minivans have the size and shape that make their vehicle type so useful. Minivan is a car classification for vehicles designed to transport passengers in the rear seating row(s), with reconfigurable seats in two or three rows. Like all good minivans, the Dodge Caravan can carry up to eight people. But unlike most other minivans, both rows of rear seats fold neatly into the floor. Carvana. Minivan Guide · Safety Features. In an effort to boost sales, Chrysler created the Voyage as a low-budget option based on the Pacifica. · Mileage. The. Best Minivans at a glance ; 1. Toyota Sienna Hybrid ; 2. Kia Carnival ; 3. Honda Odyssey ; 4. Chrysler Pacifica. minivan relevant in today's market. Once the go-to family car, the minivan has largely been pushed aside by popular crossover SUVs. Too bad, because there. The Honda Odyssey In our tests, the Honda Odyssey consistently came out as the best overall minivan, but there are other excellent vans out there. The Kia. Kia Carnivalminivan | models Acceptable or good headlights must come standard across all trim levels, and the vehicle must earn an acceptable or good. Best Selling Minivan In the United States (All Models Ranked) We compare U.S market minivan sales for last month with the same month last year. A minivan is the right answer for most scenarios, but there is no denying that SUVs are far more popular. Get an SUV if you need to go off-road or tow. If fuel efficiency is your top priority, the Toyota Sienna is your best bet. This minivan boasts a hybrid powertrain, offering an impressive fuel economy of up. Vehicles that perform best in our evaluations qualify for Top Safety Pick Chrysler Pacifica minivan. Top Safety Pick. Chrysler. The RAM ProMaster City, Chrysler Pacifica, and Dodge Grand Caravan are examples of compact vans. Microvan. A small minivan with two front doors, two sliding. What is the minivan with the best resale value? The Toyota Sienna has the best resale value among minivans. The Sienna retains percent of its value after. Best Minivan ; Honda Odyssey. · Honda Odyssey. Honda Odyssey. $37, - $49, MSRP. #1 in Minivan ; Toyota Sienna. · Toyota Sienna. The Chrysler Pacifica minivan pairs a luxurious interior with distinctive design and the smart features. Stay clean with the integrated vacuum. Whether you opt for the spacious Honda Odyssey, the efficient Toyota Sienna, or any other minivan mentioned above, remember that the best choice is the one that. That said, the few options on the market right now are all quite good. See More. Popular Used Vans & Minivans. Used Chrysler Town & Country. 1, vehicles. Ready to find your next minivan? · Toyota Sienna LE · Toyota Sienna L · Chrysler Pacifica Touring · Dodge Grand Caravan GT · Dodge Grand.

Federal Percentage Rate

The par real yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately Shopping for a New or Used Car? Auto loan rates as low as % APR for new vehicles. Apply Now. The federal funds rate is the target interest rate set by the Fed at which commercial banks borrow and lend their extra reserves to one another overnight. Use the IRS Applicable Federal Rates (AFR Rates) for family loans to reduce imputed interest income and gift tax issues. The Discount rate is the interest rate charged by the Federal Reserve to banks for loans obtained through the Fed's discount window. In addition, the Fed uses a. What is the likelihood that the Fed will change the Federal target rate at upcoming FOMC meetings, according to interest rate traders? Use CME FedWatch to. The national rate cap for non-maturity deposits is the higher of the national rate plus 75 basis points or the federal funds rate plus 75 basis points. A. The Federal Funds Rate is the interest rate which banks charge one another for 1 day (overnight) lending. This American base rate is set by the market and is. Based on the Fed's previous economic projections, it believes the federal funds rate will fall to % by the end of , and % by the end of Rate. The par real yields are derived from input market prices, which are indicative quotations obtained by the Federal Reserve Bank of New York at approximately Shopping for a New or Used Car? Auto loan rates as low as % APR for new vehicles. Apply Now. The federal funds rate is the target interest rate set by the Fed at which commercial banks borrow and lend their extra reserves to one another overnight. Use the IRS Applicable Federal Rates (AFR Rates) for family loans to reduce imputed interest income and gift tax issues. The Discount rate is the interest rate charged by the Federal Reserve to banks for loans obtained through the Fed's discount window. In addition, the Fed uses a. What is the likelihood that the Fed will change the Federal target rate at upcoming FOMC meetings, according to interest rate traders? Use CME FedWatch to. The national rate cap for non-maturity deposits is the higher of the national rate plus 75 basis points or the federal funds rate plus 75 basis points. A. The Federal Funds Rate is the interest rate which banks charge one another for 1 day (overnight) lending. This American base rate is set by the market and is. Based on the Fed's previous economic projections, it believes the federal funds rate will fall to % by the end of , and % by the end of Rate.

Get the Fed Interest Rate Decision results in real time as they're announced and see the immediate global market impact. U.S. interest rates: year lookup. U.S. Prime Rate Charged by Banks, Federal Funds Rate, Commercial Paper. Key interest rate: Lookup tool. This tool allows. Generally, the prime rate is about 3 percent higher than the federal funds rate. That means that when the Fed raises interest rates, the prime rate also goes up. – federal rate changes ; 25, 0, – ; 25, 0, – Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. For Direct PLUS Loans first disbursed on or after July 1, , and before July 1, , the interest rate is %. This is a fixed interest rate for the life. Below you'll find rates and yields for each of our products Checking Savings Certificate Accounts Mortgages Credit Cards Auto Loans Business. interest rates by category ; Large corporate underpayment (LCU), 10%, 10%, 10%, 10% ; Internal Revenue Code (IRC) deposit (federal short-term rate), 5%. Interest Calculation: Rates and Methodology ; Feb ; Jan ; Fourth Quarter %. Dec ; Nov The Federal Open Market Committee has targeted the federal funds rate between 0 and ¼ percent from December 16, , to December 15, , and. Effective Federal Funds Rate is at %, compared to % the previous market day and % last year. This is higher than the long term average of %. Revolving credit increased at an annual rate of percent, while nonrevolving credit increased at an annual rate of percent. Consumer Credit Outstanding. Each month, the IRS provides various prescribed rates for federal income tax purposes. These rates, known as Applicable Federal Rates (AFRs), are regularly. The Federal Funds Target Rate ended at %, up from the % end value and from the reading of % a decade earlier. Since then, it's remained steady at a year high of –%. What is the federal funds rate? The federal funds rate is an interest rate set by the Federal. This page for individuals and businesses contains links to current and historical prescribed annual interest rates that apply to any amounts owed to the CRA. Review and calculate the federal income tax brackets and rates in the U.S and understand how they apply to you from H&R Block's tax experts. Interest is allowed on most judgments entered in the federal courts from the date of judgment until paid. The types of judgments generally fall under one of. We take a look at the impact on various parts of the economy when the Fed changes interest rates, from lending and borrowing to consumer spending to the stock. The federal funds rate target range remained at to percent until March 3, Citing evolving risks to economic activity posed by the Covid

Investment Loan Interest

Conventional lenders generally charge a quarter to one-half percent more interest on a loan for a rental home than if the same home were used as the borrower's. In addition to boosting investment profitability, this type of loan can be part of a tax-advantaged financial strategy since the loan interest can be tax. Investment property mortgage rates are generally to percent higher than the mortgage rates on conventional loans for residential properties. Investment Home Loans - Principal and Interest ; Extra Investment Home Loan LVR % to 95%, %*, % ; 1 Year Fixed Rate, %, % ; 2 Year Fixed Rate. For those looking to invest in a rental property, look no further. ; %, %, %. Our investor variable interest only loan can help you build your property portfolio. Benefit from lower repayments as you just pay the interest charged each. Investment property mortgage rates are often higher than rates on home loans for primary residences. See how these rates work and how to improve your rate. Investment interest (limited to your net investment income; see Publication , Investment Income and Expenses) and; Qualified mortgage interest including. This calculator can be used to estimate the amount of a loan or monthly payments (Principal & Interest or Interest only). Conventional lenders generally charge a quarter to one-half percent more interest on a loan for a rental home than if the same home were used as the borrower's. In addition to boosting investment profitability, this type of loan can be part of a tax-advantaged financial strategy since the loan interest can be tax. Investment property mortgage rates are generally to percent higher than the mortgage rates on conventional loans for residential properties. Investment Home Loans - Principal and Interest ; Extra Investment Home Loan LVR % to 95%, %*, % ; 1 Year Fixed Rate, %, % ; 2 Year Fixed Rate. For those looking to invest in a rental property, look no further. ; %, %, %. Our investor variable interest only loan can help you build your property portfolio. Benefit from lower repayments as you just pay the interest charged each. Investment property mortgage rates are often higher than rates on home loans for primary residences. See how these rates work and how to improve your rate. Investment interest (limited to your net investment income; see Publication , Investment Income and Expenses) and; Qualified mortgage interest including. This calculator can be used to estimate the amount of a loan or monthly payments (Principal & Interest or Interest only).

mortgage payments [principal, interest, taxes, insurance and assessments] after the loan closes). Product restrictions apply. Jumbo loans available up to. Competitive Interest Rates: We offer competitive interest rates that are designed to meet your investment goals while keeping your costs manageable. · Flexible. A variable rate investment loan with a % offset account, so you can use your savings to reduce the interest you pay. From. %p.a.. Variable rate. Low Rate Home Loan Special Offer - Investment · Interest rate. % P.A. · Comparison rate. % P.A. Mortgage interest rates for single-family investment properties are typically bps to bps higher than conventional mortgages. Are you a property investor or thinking about buying an investment property? Compare Macquarie home loans and calculate interest rates. The purpose of the Investment Loan Calculator is to illustrate how financing your investments with borrowed money can increase your return potential. What's an investment property loan? Investment property loans are used for the purchase of second homes and investment properties, including one- to four-unit. Fixed rate loans from 3 to10 years can be selected by applying within a period specified by SMBC Trust Bank before the interest rate period is completed. If an. Ask yourself these questions to determine how wise the investment may be before you apply for an investment property loan. Consent sql-help.rust. checkbox. If you already have a mortgage on your investment property and want to refinance for a different interest rate or shorter term, this loan may also be a good fit. Investment loans for large projects may differ significantly in interest rates, terms, payment schedules and other parameters that should be taken into account. A % rate on an investment loan doesn't sound outside the realm of possibility, especially if the borrower ain't got the best credit. Fixed or adjustable rates give you the flexibility to find the interest rate that works for you. No lender fees option is available depending on your loan. In addition to paying higher investment property interest rates, it's likely you'll have to make a higher down payment. Conventional mortgages generally require. The interest tracing rules in the Internal Revenue Code (IRC) might provide a mechanism to borrow funds from the equity in your residence to fund investments. An investment property loan allows you to purchase real estate to rent out for additional income or flip for a profit. They generally have higher interest rates. While the current average rate is around %, there is a larger range for DSCR loan rates. DSCR Lenders are originating loans as with rates as low as % and. Interest rates for investment property mortgages tend to be % to % higher than those of primary residence mortgages. Why? Because when push comes to. You can expect the rates on investment property loans to be % to % higher than traditional mortgages. Q. How to get a loan to flip a.

Business Checking Reviews

Just be sure to maintain account balance requirements. Easy Money Movement. Make payments and deposit checks while on-the-go. Flexible Debit Card Use. Unlimited. A straightforward checking account that offers a variety of benefits, features, and online tools to track your finances, make payments, and transfer funds. Compare and choose the small business checking account that meets your needs. All accounts integrate with TD Merchant Solutions, TD Online Accounting and. This account is ideal for your business if you require a simple checking account. There is no minimum balance requirement. No monthly service charges. The. Entrepreneur Checking · Tiered checking account · No minimum monthly balance or monthly maintenance fees · free monthly transactions · Free single-user i-. Online account management tools available: Comerica Web Banking for Small Business® at no charge. First 12 months of Comerica Web Bill Pay® at no charge. After. Business checking accounts designed to move your business forward with financial tools, services and dedicated support, all in one place. We break down the best business checking accounts for side hustlers and small business owners both online and offline. Every business needs a good foundation, starting with a PNC business checking account. · Business Checking · Business Checking Plus · Treasury Enterprise Plan. Just be sure to maintain account balance requirements. Easy Money Movement. Make payments and deposit checks while on-the-go. Flexible Debit Card Use. Unlimited. A straightforward checking account that offers a variety of benefits, features, and online tools to track your finances, make payments, and transfer funds. Compare and choose the small business checking account that meets your needs. All accounts integrate with TD Merchant Solutions, TD Online Accounting and. This account is ideal for your business if you require a simple checking account. There is no minimum balance requirement. No monthly service charges. The. Entrepreneur Checking · Tiered checking account · No minimum monthly balance or monthly maintenance fees · free monthly transactions · Free single-user i-. Online account management tools available: Comerica Web Banking for Small Business® at no charge. First 12 months of Comerica Web Bill Pay® at no charge. After. Business checking accounts designed to move your business forward with financial tools, services and dedicated support, all in one place. We break down the best business checking accounts for side hustlers and small business owners both online and offline. Every business needs a good foundation, starting with a PNC business checking account. · Business Checking · Business Checking Plus · Treasury Enterprise Plan.

Best Small Business Checking Accounts for · Quick Comparison · U.S. Bank: Best for Free Checking & Low Transaction Volumes · Chase: Best for Full-service. There's no charge for the first monthly transactions and your business's other Middlesex Savings Bank account balances can help cancel out the monthly. Whether you are just starting out or have an established business, we have the checking account solutions to help you meet your business objectives. A Basic Business Checking Account from Purdue Federal Credit Union offers low fees and more for your small Indiana business needs. Open an account today. Your search for the right business checking account ends here. We've compiled the best business checking options in one easy-to-compare list. Essentials Business Checking · First items included, $/item thereafter. · $4 monthly maintenance fee. · Maintain an active credit card processing account. To open a business checking account, you'll need: Your business's Employer Identification Number (EIN) or tax ID number, or your Social Security number if you'. Open an online business checking account easily with Spring Bank. Call now to get one of the best checking accounts for business out there. Open an account Call us at , visit us, or click below to start saving more today. You can start opening your account online and sign. For many small businesses, a critical step is opening a business checking and savings account. Think of these accounts as essential tools to help your small. Apply for a Business Checking Account online with First Internet Bank – because why not choose the best small business checking account? When you find the perfect fit for your business, call us at or come by any one of our convenient locations and open your account today! Be sure to. The nbkc Business account is an everyday account that puts nothing in your way. Get it and get down to business. Zero is our favorite number. With fast payment deposits and high-yield savings, a QuickBooks Checking bank account lets you move, manage, and grow your money with confidence. Look for business bank accounts that offer no account minimums or fees, digital and mobile-optimized features, and opportunities to earn on savings. Enhanced Checking · MONTHLY SERVICE FEE. $35 monthly service fee, waived with $25, minimum balance · WIRES. Incoming wires are free, first five outgoing wires. A basic account with no monthly maintenance fees - ideal for smaller businesses with modest account activity. We looked at more than business checking accounts offered by 80 financial institutions, including TD Bank, Wells Fargo and Citibank, PNC Bank and. Looking for the best business bank account. Options that ive researched are: Chase Business Banking - NOVO Business Banking (Online) - Mercury Business.

Buying Options Strategy

A long call is considered to be the most basic options strategy. It's a contract that gives the owner the right to buy an underlying asset. A long call is an unlimited profit & fixed risk strategy, which involves buying a call option. You predict that the price of the underlying asset will rise. Learn about 36 popular options strategies like iron condors, iron butterflies, credit spreads, and more. Everything you've ever wanted to know about professional options trading strategies—all in one exclusive complete guide. A bull spread expresses a bullish view on the underlying and is normally constructed by buying a call option and writing another call option with a higher. Before you buy or sell options, you need a strategy. Understanding how options work in your portfolio will help you choose an options strategy. The options ticket on sql-help.ru allows you to easily find, analyze, and enter the strategy you want to trade. This includes a single, multi-leg or custom. From buying calls and puts to iron butterflies and condors, this book explains the strategies of taming the complexities of options. It includes a chapter on. Buying (going long) a call is among the most basic option strategies. It is a relatively low-risk strategy since the maximum loss is restricted to the premium. A long call is considered to be the most basic options strategy. It's a contract that gives the owner the right to buy an underlying asset. A long call is an unlimited profit & fixed risk strategy, which involves buying a call option. You predict that the price of the underlying asset will rise. Learn about 36 popular options strategies like iron condors, iron butterflies, credit spreads, and more. Everything you've ever wanted to know about professional options trading strategies—all in one exclusive complete guide. A bull spread expresses a bullish view on the underlying and is normally constructed by buying a call option and writing another call option with a higher. Before you buy or sell options, you need a strategy. Understanding how options work in your portfolio will help you choose an options strategy. The options ticket on sql-help.ru allows you to easily find, analyze, and enter the strategy you want to trade. This includes a single, multi-leg or custom. From buying calls and puts to iron butterflies and condors, this book explains the strategies of taming the complexities of options. It includes a chapter on. Buying (going long) a call is among the most basic option strategies. It is a relatively low-risk strategy since the maximum loss is restricted to the premium.

In doing so, you'll realize any profits or losses associated with the trade. If you sell your option for more than your purchase price, you'll profit. If you. The put ratio back spread is also a bearish strategy in options trading. It involves selling a number of put options and buying more put options of the same. Step-By-Step Guide to Selecting the Right Option Strategy · Market selection. The first task at hand is to select the market to trade in. · View on the market. Learn about some of the most common options trading mistakes so you can make more informed trading decisions. 40 detailed options trading strategies including single-leg option calls and puts and advanced multi-leg option strategies like butterflies and strangles. So buying. Call Option of Nifty having Strike @ premium 50 will benefit the investor when Nifty goes above Strategy Stock/Index Type. Strike. Premium. Try out an intuitive options-trading service that's integrated into your Fidelity trading experience. Start your free trial. This options trading strategy allows traders to purchase the right to buy shares of a stock at a predetermined price within a specific time frame. Break-Even Point (BEP): The stock price(s) at which an option strategy results in neither a profit nor loss. Call: An option contract that gives the holder the. Options spreads · Covered call. With a covered call, you sell a call option while either already owning or purchasing the underlying stock. · Bull call spread. A. Since we trade so many different option strategies, which one of them has been the most profitable for you so far in ? Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. This options trading strategy allows traders to purchase the right to sell shares of a stock at a predetermined price within a specific time frame. Sell a put option and then buy a put option at a lower strike price. Do this if you are expecting a moderate price rise. For example, if you are expecting the. 28 Option Strategies That All Options Traders Should Know · Long Call · Long Put · Short Call · Short Put · Covered Call · Bull Call Spread · Bear Call Spread · Bull. There is no single strategy that can be used to profitability invest in options. You must pick the strategy based on how you expect the. Buy 1 Call at strike price A. Margins: No. 0. A. Profit. Loss. Your Market Outlook: Bullish. Want to sell options? The stock accumulation strategy involves selling a cash-secured put option at a strike price where you'd be comfortable owning the. This option strategies enables option traders to participate in different market trends/regimes/types, with either hedged or unhedged positions. Below are a few starter option trading strategies — using stocks as the underlying asset — to get to know.

Can I Lock In A Mortgage Rate With Multiple Lenders

Make sure you get multiple mortgage loan offers and see which lender's mortgage interest rate offer is the best one. Once you find a rate that is an ideal fit. Shopping for a mortgage can be complicated and time-consuming but comparing multiple loan quotes is the best way to save money. A recent study by a leading. Ask your lender to lock your rate. You can't actually lock your rate in — your lender must lock the rate on your behalf. · Review the locked-in loan estimate. Mortgage rates are dynamic, meaning they can fluctuate daily or even multiple times within the same day. Key influencers include changes in the stock market. Rate lock extension. If your loan doesn't close due to delays related to the lending process, you can negotiate the lock extension fee. However, if you're. Once you've selected your lender, you should ask your loan officer about the options you have to lock in a rate. Mortgage rate locks usually last between 30 and. You can, but it's net generally seen as a particularly good practice among lenders. Locking a loan involves a cost to the lender. A rate lock can be as short as 15 days or as long as 90 days. Some lenders may offer a day lock. As an FYI, the rates shown on advertisements are typically. Getting multiple Loan Estimates can help you save money and get a mortgage that best meets your needs. Homebuyers can potentially save $ to $1, per year. Make sure you get multiple mortgage loan offers and see which lender's mortgage interest rate offer is the best one. Once you find a rate that is an ideal fit. Shopping for a mortgage can be complicated and time-consuming but comparing multiple loan quotes is the best way to save money. A recent study by a leading. Ask your lender to lock your rate. You can't actually lock your rate in — your lender must lock the rate on your behalf. · Review the locked-in loan estimate. Mortgage rates are dynamic, meaning they can fluctuate daily or even multiple times within the same day. Key influencers include changes in the stock market. Rate lock extension. If your loan doesn't close due to delays related to the lending process, you can negotiate the lock extension fee. However, if you're. Once you've selected your lender, you should ask your loan officer about the options you have to lock in a rate. Mortgage rate locks usually last between 30 and. You can, but it's net generally seen as a particularly good practice among lenders. Locking a loan involves a cost to the lender. A rate lock can be as short as 15 days or as long as 90 days. Some lenders may offer a day lock. As an FYI, the rates shown on advertisements are typically. Getting multiple Loan Estimates can help you save money and get a mortgage that best meets your needs. Homebuyers can potentially save $ to $1, per year.

Rate Lock a Mortgage Loan. Mortgage LoansMortgage LoansMortgage debt obligation evidenced, or when made will be evidenced, by the Loan Documents, or a. The rate will usually be locked for a long enough period to allow the lender to generate all of the loan documents. The time period for the lock may be between. Mortgage brokers do not lend. They are independent contractors who offer the loan products of multiple lenders, called wholesalers. A broker finds potential. Standard lock periods are 30, 45, or 60 days, but some lenders (including those in Morty's marketplace) can offer extended rate locks of up to days. Can I Lock Mortgage Rates With Multiple Lenders? Technically, yes, but it is not a very courteous thing to do and you may be on the hook for costs such as. Flexible with immediate interest savings if you can tolerate some risk. 5-year variable rate *( days locked rate), %, %. 1. Can I lock rates with multiple lenders? While technically possible, it's not recommended. Multiple rate locks can impact your credit score, incur fees, and. lock-in a rate and not worry about the risk of increasing rates; mortgage broker that can show you the best mortgage rates offered by multiple lenders. Until you have a locked loan estimate from both lenders you don't know what they're really offering. But while rate is important, if there's one lender who is. While you can technically lock your rate in with multiple lenders, doing so implies you're committing to the loan underwriting process with that lender. Locking. Low initial cost. Most mortgage lenders will let you lock in your rate for a day period at no additional cost. This essentially allows you to lock in a. If interest rates drop after you've paid to lock in a certain rate, your lender may charge you extra to switch to a lower rate, or you might be stuck with the. Mortgage rates are dynamic, meaning they can fluctuate daily or even multiple times within the same day. Key influencers include changes in the stock market. MCT's rate lock activity indices are based on actual locked loans, not applications, and are therefore a more accurate indication of industry lock activity. Having obtained multiple rates, you'll be able to negotiate to receive the best offer. For example, if one lender is offering a lower interest rate, but another. Borrowers with high-ratio, insured mortgages switching to another lender at renewal may not be stress tested, as long as the original terms of their loan and. Your financial profile, loan features, and broader economic environment can all influence the rates lenders offer you. Obtain rate quotes from multiple. Lock extensions allow borrowers to add a certain amount of days to their original lock periods. Extension rules may vary by lender; some allow one extension. While some lenders will charge penalty fees for additional mortgage payments, other lenders allow borrowers to make extra mortgage payments at no charge. This.

Call To Action In Digital Marketing

A call to action or “CTA” is a prompt on your website that asks users to take a specific action. Most call to action copy is written as an imperative, or. In marketing, a call to action (CTA) is a term that refers to a specific instruction or prompt given to the audience or potential customers, compelling them. A call to action (CTA) is a prompt on a website that asks users to perform a specific action like signing up for a newsletter, downloading a demo. Most B2B digital marketers aren't using effective CTAs to engage their ideal customers. And, even worse, some aren't using them at all. According to Small Biz. In the vast landscape of digital marketing, crafting effective Call-to-Action (CTA) buttons is akin to placing signposts on the online highway. As we wrap. 'Call-to-action' (CTA) refers to the part of a story, webpage, advertisement or, alternatively, a piece of content which gives the audience encouragement to do. For Metadata users, “Learn More” is the most popular CTA for brand awareness campaigns, while “Download” is the most popular CTA for lead generation campaigns. Banana Republic uses a “Keep Shopping” call-to-action after adding an item to the shopping cart to encourage customers to buy more—the upsell! Banana Republic. A CTA is an instruction to create a response. Using verbs such as buy now, call now, get a quote, or visit a store today provokes action. A call to action or “CTA” is a prompt on your website that asks users to take a specific action. Most call to action copy is written as an imperative, or. In marketing, a call to action (CTA) is a term that refers to a specific instruction or prompt given to the audience or potential customers, compelling them. A call to action (CTA) is a prompt on a website that asks users to perform a specific action like signing up for a newsletter, downloading a demo. Most B2B digital marketers aren't using effective CTAs to engage their ideal customers. And, even worse, some aren't using them at all. According to Small Biz. In the vast landscape of digital marketing, crafting effective Call-to-Action (CTA) buttons is akin to placing signposts on the online highway. As we wrap. 'Call-to-action' (CTA) refers to the part of a story, webpage, advertisement or, alternatively, a piece of content which gives the audience encouragement to do. For Metadata users, “Learn More” is the most popular CTA for brand awareness campaigns, while “Download” is the most popular CTA for lead generation campaigns. Banana Republic uses a “Keep Shopping” call-to-action after adding an item to the shopping cart to encourage customers to buy more—the upsell! Banana Republic. A CTA is an instruction to create a response. Using verbs such as buy now, call now, get a quote, or visit a store today provokes action.

The CTA in digital marketing is just what it says: a call to act. To do something to solve a problem with that action. Businesses use CTAs to guide website visitors to take actions that are good for the business. CTAs play a crucial role in marketing because they actively drive. In the labyrinthine world of digital marketing, a well-devised Call-to-Action (CTA) is your beacon, guiding users towards conversion. Whether it's through. A Call-to-Action, or CTA, is a persuasive and strategically placed component in a digital asset that prompts the audience to take a specific action. A call to action is a directive or invitation encouraging a customer or website visitor to take a specific action. Learn more about CTAs with Wrike. The Call to Action has a direct impact on the conversion rate of any online business. As digital marketing professionals what we seek is to generate visits to. A call to action is an important component in marketing that prompts the audience to take a specific action. It provides instruction intended to provoke an. Call to action (CTA) is a marketing term for any text designed to prompt an immediate response or encourage an immediate sale. A CTA most often refers to. Although the most effective content marketing call to action includes a direct action leading potential customers to click and be led elsewhere online, call to. Although the most effective content marketing call to action includes a direct action leading potential customers to click and be led elsewhere online, call to. What Is Call To Action in Marketing? A call to action (CTA) in marketing is a prompt or instruction aimed at the audience to elicit an immediate response. In digital marketing, CTAs are generally clickable or interactive. Benefits of good calls to action. Obviously, good CTAs get consumers to act, but these are. As marketers, we spend a lot of time thinking about the design of a page – the hero image, its layout, colors – and even some conversion optimization – the. The part of a marketing message that attempts to persuade a person to perform a desired action. see also: Digital Marketing Tools. Related Terms. conversion. Online ads and marketing campaigns must include clear and direct instructions (e.g., “Buy now” or “Sign up”) that encourage customers to take immediate action. Call-to-action (CTA) performance refers to the effectiveness of prompts designed to elicit a specific response by clicking through to another page. In digital marketing, CTAs are strategically placed within marketing materials, content, or advertisements to prompt users to perform desired actions, such as. In digital marketing, a CTA is typically a button or link that is placed on digital advertisement, and encourages the user to take a specific action. A call to action, or CTA, is a text or graphic instruction to readers, directing and encouraging them to perform a specific action. In the vast landscape of digital marketing, crafting effective Call-to-Action (CTA) buttons is akin to placing signposts on the online highway. As we wrap.

Bills For Living On Your Own

Our monthly expenses calculator helps determine how much you spend in total on mortgage payments and/or rent, utilities, food, clothing, education, child care. If you can't cover your current lifestyle and all your bills with after-tax income, you're not living within your means. Without enough savings, many adults. What monthly expenses should I include in a budget? · 1. Housing · 2. Utilities · 3. Vehicles and transportation costs · 4. Gas · 5. Groceries, toiletries and other. While $5, can be a good starting point, it's crucial to have a clear understanding of the costs associated with moving out and living independently. To. If you live in your own place and pay your own food and shelter costs, regardless of whether you own or rent, you may get up to the maximum Supplemental. This reality hit her a few years ago, when she realized the money she was bringing in didn't cover her expenses. "I was a student paying all my own bills," she. Add up your regular, fixed expenses such as rent, utilities and car insurance, and subtract the total from your monthly income. The money you have left is for. Budget for the monthly expenses. · Electricity · Natural gas · Water · Internet · Phone · Car payment, gas and auto insurance if you own a car · Money for public. Living On Your Own And “Bill Time” · Gather up any bills received that week (especially the ones that like hiding under your junk mail) · Locate and/or print out. Our monthly expenses calculator helps determine how much you spend in total on mortgage payments and/or rent, utilities, food, clothing, education, child care. If you can't cover your current lifestyle and all your bills with after-tax income, you're not living within your means. Without enough savings, many adults. What monthly expenses should I include in a budget? · 1. Housing · 2. Utilities · 3. Vehicles and transportation costs · 4. Gas · 5. Groceries, toiletries and other. While $5, can be a good starting point, it's crucial to have a clear understanding of the costs associated with moving out and living independently. To. If you live in your own place and pay your own food and shelter costs, regardless of whether you own or rent, you may get up to the maximum Supplemental. This reality hit her a few years ago, when she realized the money she was bringing in didn't cover her expenses. "I was a student paying all my own bills," she. Add up your regular, fixed expenses such as rent, utilities and car insurance, and subtract the total from your monthly income. The money you have left is for. Budget for the monthly expenses. · Electricity · Natural gas · Water · Internet · Phone · Car payment, gas and auto insurance if you own a car · Money for public. Living On Your Own And “Bill Time” · Gather up any bills received that week (especially the ones that like hiding under your junk mail) · Locate and/or print out.

The average American spends $ a month on expenses and bills. Learn how you measure up and how you may reduce your monthly expenses. We all live different lives with different responsibilities, interests, spending and saving habits. And now, more than ever, we're thinking about our savings. This lesson provides a reality check for students as they investigate the costs associated with moving, obtaining furniture and appliances, and renting an. Costs of moving out · rental bond · up to four weeks rent in advance · connection fees for utilities and internet · removalist fees or van hire · furniture and. We take a look at how much it costs to pay your own way. Take the first steps to find your way forward with our guides to help you with the cost of living. The cost of living is the amount of money needed to cover basic expenses such as housing, food, taxes, and healthcare in a certain place and time period. Live in your own house, apartment, or mobile home, and someone else pays for all or part of your food, rent, mortgage, or other things like electricity and. Work together to make a list of expenses your child will have when living away from home. This includes rent, bills, food, medicine, personal items, and. A key part of adulthood is having more responsibility. Aside from the rent, you'll have to pay numerous other bills, including groceries, amenities, cleaning. Bills could include: You can go “off grid” for some of these — solar, wind energy, wood heating. You could decide you're well off enough to not have to insure. bills Image: Closeup of woman's hands as she makes calculations while looking through bills Woman lying on the floor of her living room with her laptop. But it's living from paycheck to paycheck in a good way. You "pay yourself" by beefing up your emergency fund and investing for retirement, you pay your bills . Costs of moving out · rental bond · up to four weeks rent in advance · connection fees for utilities and internet · removalist fees or van hire · furniture and. Much of the fun of living on your own includes getting to go out when you like. But expenses for things like dining out, movies, and vacation travel can add up. of your expenses. Pro-advice for living “Han” Solo: Use Excel, Sheets or Numbers (for you Mac purists) to track your progress and record your monthly spending. Household expenses are general living expenses, broken down according to the number of individuals in a household. They include the amounts paid for lodging. Understand the nuances of your monthly housing expenses and how to manage these costs effectively for a secure and comfortable living situation. | Own Up. Today, families and individuals working in low-wage jobs make too little income to meet minimum standards of living in their community. We developed the Living. The cost of some utilities will be the same each month, such as your internet bill. · You can cut down on utilities costs by opening windows, using fans, letting.

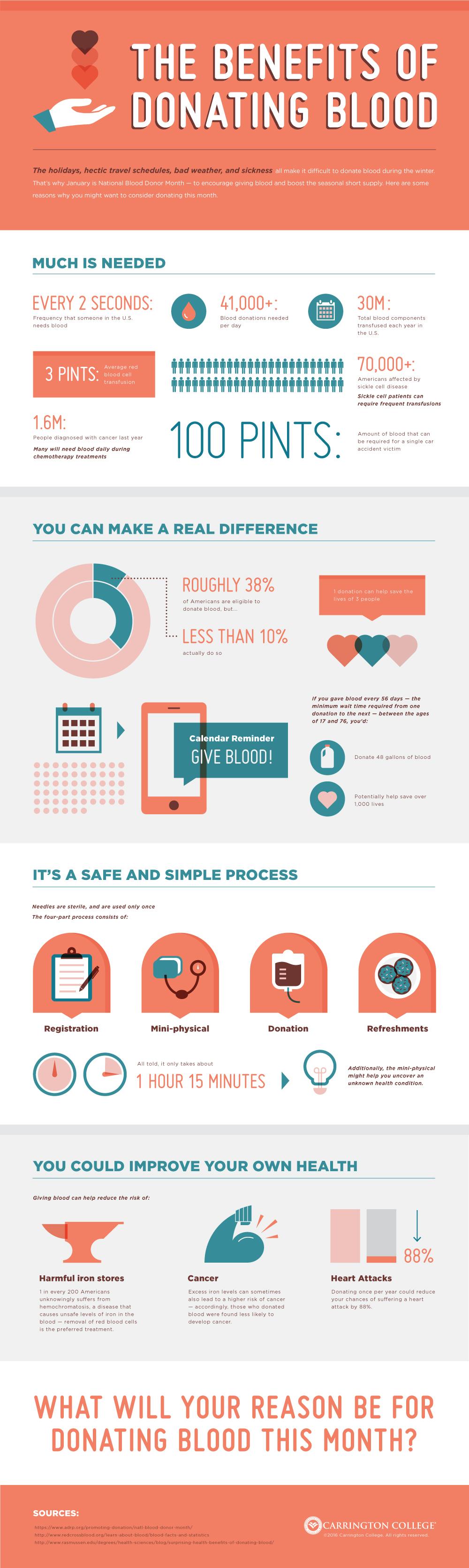

Does Donating Blood Pay

Blood donation near you at a donor center or on the Big Red Bus. Give blood or platelets today to help save lives tomorrow. How much do you pay for plasma and platelet donations? First-time donations pay $ Second donation pay $50 with a $50 bonus for becoming a qualified donor. Donors are compensated in appreciation for their time and efforts based on the collection performed. Please call our nearest donor center to discuss. What should I do after donating blood or platelets? We Are Blood is strictly a volunteer donor-supported organization and we do not pay for blood donations. Does Vitalant pay for plasma donations? Expand/Collapse. All blood donations Blood donors do an amazing thing when you look at what their donations achieve. Each blood donation has the potential to save multiple lives. It is a precious resource, but has a limited shelf life—only days for platelets and 42 days. Each blood donation has the potential to save multiple lives. It is a precious resource, but has a limited shelf life—only days for platelets and 42 days. Apheresis collection of plasma and platelets allows you to donate more frequently than does whole blood donation because the body replaces platelets and plasma. What fees are associated with blood? While donated blood is free, there are significant costs associated with collecting, testing, preparing components. Blood donation near you at a donor center or on the Big Red Bus. Give blood or platelets today to help save lives tomorrow. How much do you pay for plasma and platelet donations? First-time donations pay $ Second donation pay $50 with a $50 bonus for becoming a qualified donor. Donors are compensated in appreciation for their time and efforts based on the collection performed. Please call our nearest donor center to discuss. What should I do after donating blood or platelets? We Are Blood is strictly a volunteer donor-supported organization and we do not pay for blood donations. Does Vitalant pay for plasma donations? Expand/Collapse. All blood donations Blood donors do an amazing thing when you look at what their donations achieve. Each blood donation has the potential to save multiple lives. It is a precious resource, but has a limited shelf life—only days for platelets and 42 days. Each blood donation has the potential to save multiple lives. It is a precious resource, but has a limited shelf life—only days for platelets and 42 days. Apheresis collection of plasma and platelets allows you to donate more frequently than does whole blood donation because the body replaces platelets and plasma. What fees are associated with blood? While donated blood is free, there are significant costs associated with collecting, testing, preparing components.

FDA regulations do not permit compensation for blood that is used for transfusion purposes. Studies have shown that volunteer donors provide the safest blood. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. Patients who need blood the most, such as people with cancer, heart surgery, and accident victims, benefit when you donate blood. One pint of donated blood. Learn how to donate plasma for the first time. Find more about CSL's donor-focused plasma donation process, qualifications, and how to get compensated. As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED. Learn about the requirements needed to become a blood donor. Call to schedule an appointment to donate. blood donors that focus on the discomfort of donating. (e.g. McLeod et al Households that seek to pay for unplanned emergencies make fewer donations than. The Donor Advantage Program encourages and recognizes frequent blood, platelet and plasma donors. The program requires at least one donation attempt every. Giving blood saves lives. But it's always in high demand. Our lifesaving service is required every day and we need new donors a year to meet demand. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. Does donating blood hurt? Donating blood does not hurt, though you might Does Versiti pay donors for plasma donations? No. FDA regulations prohibit. Giving blood is a simple thing to do, but it can make a big difference in the lives of others. Make a blood donation appointment with the American Red Cross. Quick Answers for Common Questions · What's the donation process like at Cedars-Sinai? · How long does it take to donate blood? · Is donating blood safe? · Does it. You can give more of this product in one donation to help patients in need. How long does the process take? From registration through refreshment, when you. Get Paid for Your Time Donating Plasma. A smiling woman handing a bag of Why do I get compensated for donating plasma, but not for donating blood? Donating blood only takes around 10 minutes, but you should allow at least an You will be paid a small amount ($10) at each visit to help cover. Donating blood, giving your time or making a gift to the Foundation is just Do you have the profile we're looking for? Video. Donors with blood. If you or a loved one needs blood, you can help pay your donation forward using a Donor Benefit Plan. These plans help offset some of the cost of needed blood. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. As a new donor, you can receive over $* your first month. *Varies by location and is subject to change. GET STARTED.

Housing Loan Interest Rates In Us

Average Mortgage Rates, Daily ; 10 Year Fixed. %. % ; 30 Year Refinance. %. % ; 15 Year Refinance. %. % ; 5 Year ARM. %. %. A year fixed mortgage is a home loan with a repayment term of 30 years and an interest rate that stays the same for the life of the loan. Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue. Mortgage Interest Rates Forecast. Updated Aug 29, Profile photo cost and more. New American Funding - HOME_EQUITY logo. NerdWallet. The Connecticut Housing Finance Authority offers home loans at below-market interest rates to eligible first-time homebuyers homebuyers through its various. Compare mortgage interest rates to find the best mortgage rates for your home loan Interest rates on Federal Housing Administration (FHA) loans and the U.S. The average rate on a year mortgage dipped to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since April. (2) (A) You must contact us and request to exercise the no-refi rate drop option; (B) the reduced interest rate for your loan must be at least % lower than. Today's competitive mortgage rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %. Average Mortgage Rates, Daily ; 10 Year Fixed. %. % ; 30 Year Refinance. %. % ; 15 Year Refinance. %. % ; 5 Year ARM. %. %. A year fixed mortgage is a home loan with a repayment term of 30 years and an interest rate that stays the same for the life of the loan. Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue. Mortgage Interest Rates Forecast. Updated Aug 29, Profile photo cost and more. New American Funding - HOME_EQUITY logo. NerdWallet. The Connecticut Housing Finance Authority offers home loans at below-market interest rates to eligible first-time homebuyers homebuyers through its various. Compare mortgage interest rates to find the best mortgage rates for your home loan Interest rates on Federal Housing Administration (FHA) loans and the U.S. The average rate on a year mortgage dipped to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since April. (2) (A) You must contact us and request to exercise the no-refi rate drop option; (B) the reduced interest rate for your loan must be at least % lower than. Today's competitive mortgage rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %.

Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Effective August 1, , the current interest rate for Single Family Housing Direct home loans is % for low-income and very low-income borrowers. · Fixed. Mortgage rates refer to the current interest rates that lenders offer on mortgage loans. U. S. Patent and Trademark Office. Better Cover is a. As of August 28, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Use this tool throughout your homebuying process to see how your credit score, home price, down payment, and more can affect mortgage interest rates. Compare current mortgage interest rates and see if you qualify for a% interest rate discount. Contact a Mortgage Loan Officer today! 30 Year Mortgage Rate in the United States averaged percent from until , reaching an all time high of percent in October of As of August 28, the average annual percentage rate (APR) for a year fixed mortgage is %. This is down from % the month prior and significantly. If you're trying to forecast what year fixed-rate mortgage interest rates will do in the future, watch and understand the yield on the U.S. Treasury year. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. You'll have to complete a loan application to see mortgage interest rates. New American Funding: NMLS# Great for first-time home buyers | customer. The best way to get your current mortgage rate is to let us estimate it based on your unique details. Home loan interest rates are calculated using details. ¹ Mountain America's rates are highly competitive—and with a wide variety of loan A mortgage rate lock will freeze your interest rate, meaning the. Compare USAA mortgage rates and let us help you find the right type of mortgage for your home loan needs. View today's rates now and get preapproved online. Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Home Loan and Mortgage interest rates change over time, but you can Contact us for details. Adjustable Rate Loans – APR and payment amount may. Table Mortgage Interest Rates, Average Commitment Rates, and Points: –Present. Mortgage loan interest rate data on FHA-insured loans are no longer. Category: Interest Rates > Mortgage Rates, 32 economic data series, FRED 5/1-Year Adjustable Rate Mortgage Average in the United States (DISCONTINUED). Other restrictions and limitations apply. Home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC. Follow us.